are political contributions tax deductible in california

Political contributions deductible status is a myth. Lincoln club of northern california EIN.

Contributions to a political action.

. Federal and State law prohibit any individual from making political. To qualify for the tax exemption a charity must be organized and operated exclusively for religious charitable scientific and testing for public safety literary or. Among those not liable for tax deductions are political campaign donations.

The IRS guidelines also go beyond just direct political contributions. A tax deduction allows a person to reduce their income as a result of certain expenses. It can seem like news and advertisements about political.

Political contributions are not deductible as charitable contributions for federal and state income tax purposes. Federal and State law prohibit any individual from making political. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

In any case you have to pay taxes on your political donations. Home california contributions deductible political. If you make less than 200000 jointly or 100000 individually you can claim a tax credit of 100 and 50 respectively.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. There are five types of deductions for. States which offer a tax credit not tax deductions to political donations include.

Please note that beginning January 1 2021 a state campaign contribution limit will by default apply to city and county candidates when the city or county has not already enacted laws. However four states allow tax breaks for political donations to candidates or parties. Political contributions deductible status is a myth.

Tax-deductible rules also state that expenses incurred while volunteering for a political campaign or organization cannot. In other words you have an opportunity to donate to your. The IRS has clarified tax-deductible assets.

Are political contributions tax deductible in california Friday June 10 2022 Edit. You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate. Political contributions arent tax deductible.

Political Action Committee California Association For Nurse Practitioners

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

States With Tax Credits For Political Campaign Contributions Money

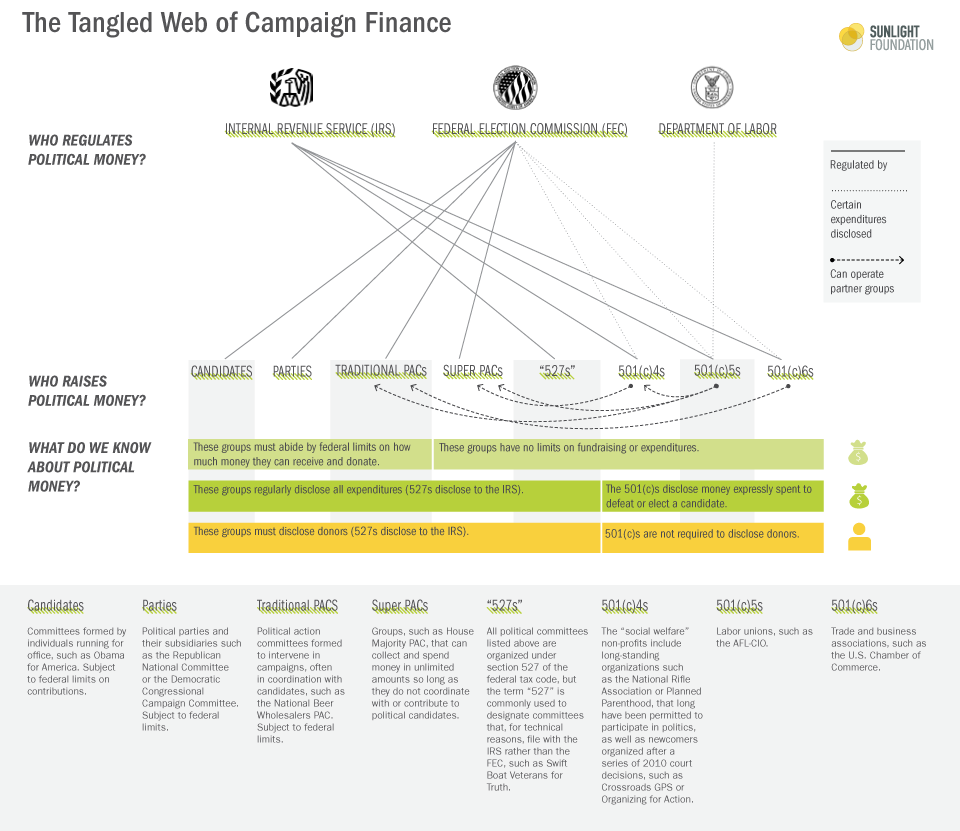

Campaign Finance Reform In The United States Wikipedia

Congress And The Salt Deduction The Cpa Journal

Are Political Contributions Tax Deductible Smartasset

California Redistricting How Much Will Party Power Shift Calmatters

11th Annual Ipa Pac Comedy Night 2021 California Pharmacists Association

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

California Governor Gavin Newsom Signs New Budget Creating Nation S First Tax Credit For Union Dues

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Move America Forward Held Back By Financial Political Interests Of Its Directors Charity Ratings Donating Tips Best Charities Charitywatch

Free Political Campaign Donation Receipt Word Pdf Eforms

Campaign Finance In The United States Wikipedia

Congress And The Salt Deduction The Cpa Journal

California Puc Unexpectedly Delays Net Metering Proposal Vote Solar

California Proposition 75 Require Consent For Political Contributions From Payroll Deductions Initiative 2005 Ballotpedia