does texas require an inheritance tax waiver form

Noncompliance with electronic reporting or payment penalty waivers. Today Virginia no longer has an estate tax or inheritance tax.

Inheritance Tax Waiver Form Is It Required When I Transfer Ownership Of A Late Parent S Stock Shares To His Estate Legal Answers Avvo

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1.

. Inheritance Tax Waiver Form. This varies based on an inheritance taxes inheritance tax does waiver of the value of date does inheritance taxes on the tax waiver rule provided payment deadline for the reasonable rates. 21 posts related to Does The State Of Illinois Require An Inheritance Tax Waiver Form.

How do you get an inheritance tax waiver. The relationship of the. The process for getting an inheritance tax waiver depends on the state.

Inheritance tax is a. If the deadline passes without a waiver. When authorization is required for the release of personal property it is.

Power of Attorney Forms. Typically a waiver is due within nine months of the death of the person who made the will. Sexually Oriented Business Fee Forms.

Inheritance Tax Waiver Form Nj. State Of Il Inheritance Tax Waiver Form. Complete Illinois Inheritance Tax Waiver Form online with US Legal Forms.

Is an inheritance tax waiver form required in Illinois. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. An Illinois Inheritance Tax.

Ohio does not require a waiver if the transfer is to a surviving spouse and the value of the estate is less than 25000. Late returnpayment penalty waivers. As of 2019 only twelve states collect an inheritance tax.

The type of return or form required generally depends on. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. You usually need to contact the department that collects.

Natural Gas Tax Forms. The state of Texas is not one of these states. Mixed Beverage Tax Forms.

With the elimination of. The federal government of the United States does have an estate tax. The Language of a Waiver Form.

Kentucky Inheritance and Estate Tax Forms and Inheritance and Estate from documentspub. While New York doesnt charge an inheritance tax it does include an estate tax in its laws. How do I get an inheritance tax waiver.

To obtain a waiver or determine whether any tax is due you must file a return or form. If you need additional information call us toll free. The state has set a 525 million estate tax exemption meaning if the decedents.

Texas Estate Tax Everything You Need To Know Massingill

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

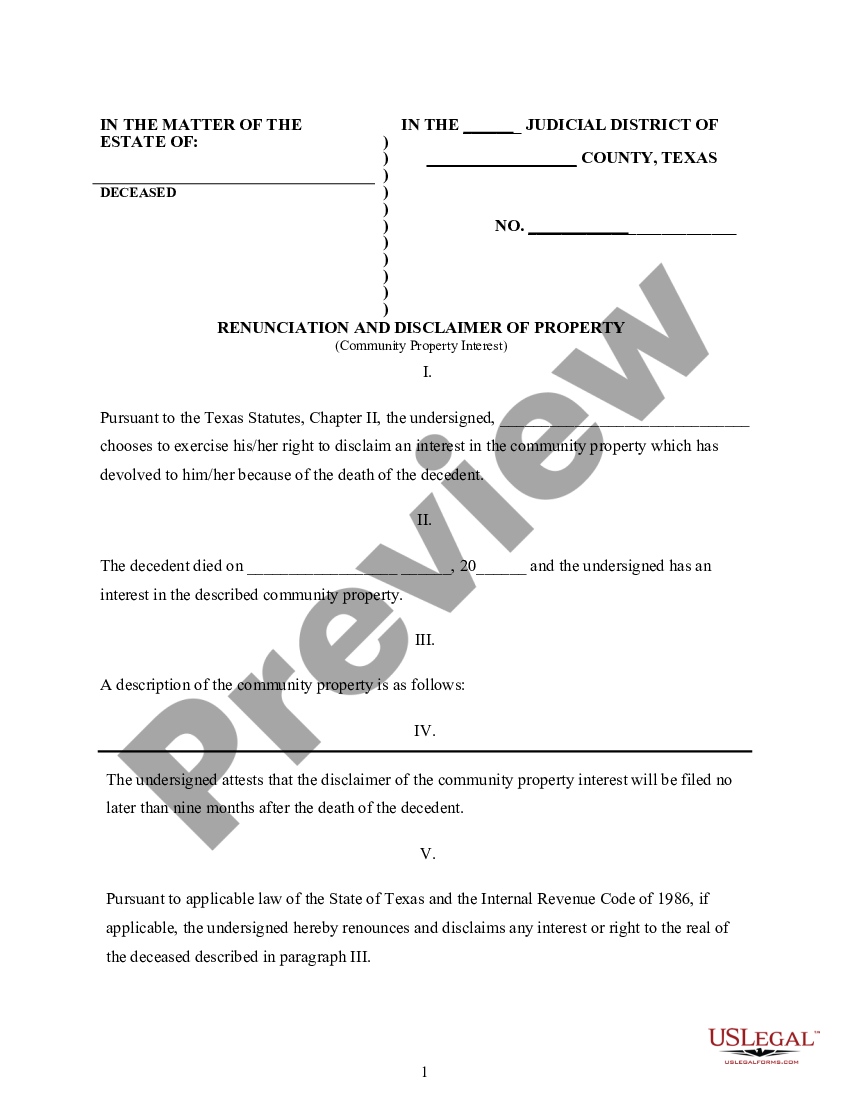

Texas Renunciation And Disclaimer Of Property Relinquish Rights To Property Form Texas Us Legal Forms

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Death And Taxes Nebraska S Inheritance Tax

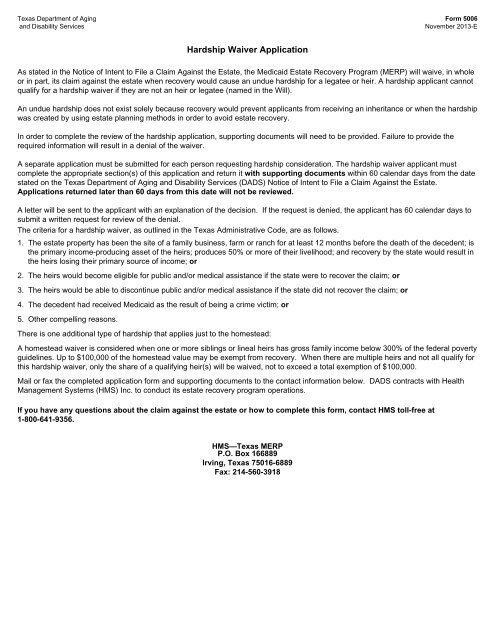

Hardship Waiver Application The Texas Department Of Aging And

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Tenncare Tax Waiver Fill Out Sign Online Dochub

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

Texas Inheritance Laws What You Should Know Smartasset

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Does Your State Have An Estate Or Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nj Inheritance Tax Waivers When They Are Needed And Not Needed New Jersey Attorneys

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Transfer On Death Tax Implications Findlaw

Nebraska Inheritance Tax Worksheet Form 500 Fill Online Printable Fillable Blank Pdffiller